The recent rise of Moderna’s (MRNA.O), opens new tab stock tells a grim tale. The $56 billion company which pioneered a Covid vaccine has seen its market value rise 40% since the discovery of bird flu in American cows in March, opens new tab. The benefit to Moderna of a new outbreak is probably far less.

The H5N1 flu that’s common in various animals might mutate to spread between humans. Influenzas have a history of making such jumps. About half of the hundreds of people diagnosed since 2003 have died. This virulence can’t be assumed, however, as mild cases have been missed and the virus will change. Likewise, the odds of a strain spreading easily, and when, are impossible to predict.

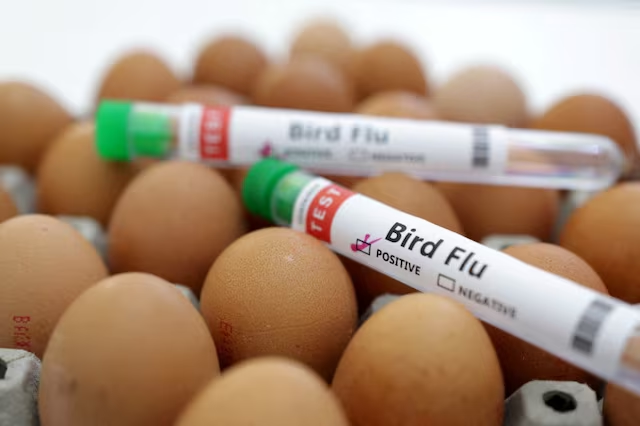

More certain is the value of Moderna’s mRNA technology, which uses a virus’ genetic code to instruct the body to make antibodies. The company and its German rival BioNTech developed effective Covid vaccines faster than traditional methods. MRNA vaccines may have another edge. Traditional inoculations use inactivated virus, grown in fertilized eggs. The U.S. government even keeps a secret hoard of hens, to ensure millions of eggs are available. The problem is that avian flu might kill fertilized eggs, hampering production.

The value to society could be vast. The International Monetary Fund estimated in 2022 that the economic damage from Covid would exceed $12.5 trillion. The tab for a more deadly bird flu could be higher, and a vaccine might slash trillions off this tab.

That’s why governments are stockpiling vaccines. The U.S. agreed to buy 4.8 million doses, from Australia’s CSL (CSL.AX), If Uncle Sam buys a similar amount from Moderna, and pays a rich, $100 a shot, that’s $500 million of revenue. These vaccines may be a poor match against a pandemic strain, so governments are reluctant to buy too many.

A pandemic opportunity would be larger. Moderna and Pfizer (PFE.N), sold about $130 billion of Covid vaccines during the pandemic. Assume similar total revenue, that Pfizer takes half, and Moderna’s net margin is 66%, the same as in 2021. The company’s profit would be $43 billion.

But if the chance of an outbreak is 33%, the boost to Moderna’s bottom line falls to $14 billion – less than the increase in its market value since March. Other firms may grab a share of sales.

Post pandemic, global flu shot sales would probably be similar as today, or $7 billion annually. Moderna has planned for years to sell influenza vaccines. So this opportunity presumably was already reflected in its valuation.

It’s striking that other stocks are not pricing in the possibility of a pandemic. Pfizer’s valuation hasn’t changed much since March, and shares in prior pandemic winners such as exercise bike firm Peloton Interactive (PTON.O), and communications company Zoom Video Communications (ZM.O), are down. Moderna is a lone omen.

Follow @rob_cyran, on X

CONTEXT NEWS

The U.S. Centers for Disease Control and Prevention said that as of June 10, there is an ongoing multi-state outbreak of H5N1 avian influenza in dairy cows.

Three U.S. cases of the disease have been diagnosed in humans following exposure to infected cows.